By Alyson Queen –

Don’t bother looking outward to Toronto and Vancouver for the country’s hottest housing market – because it’s happening in your own backyard in Kitchissippi. Literally.

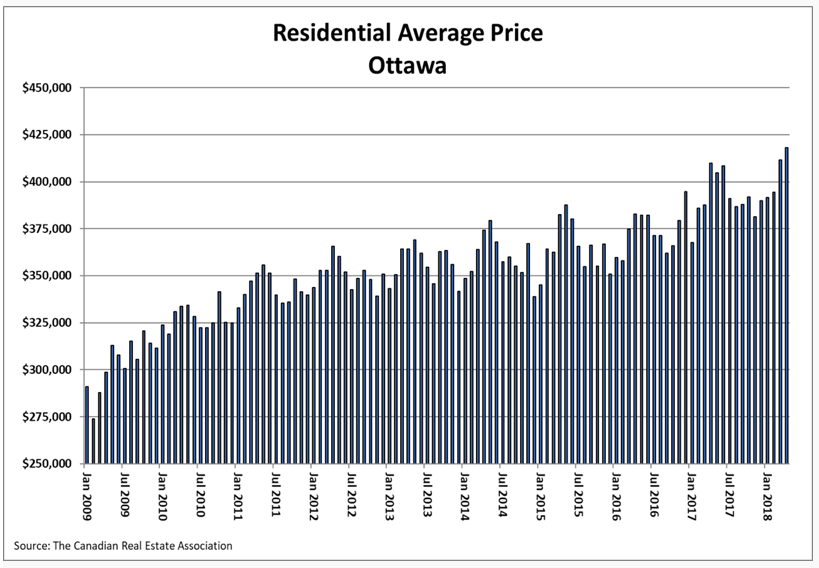

According to the Canadian Real Estate Association’s latest numbers for April (the most recent available), sales were up in Ottawa by nearly 10% compared to this time last year – with nearly 25% of all residential properties selling above the list price. That’s in comparison to the 14% national drop in sales, which marked a seven-year low. The report also noted that Ottawa’s condo sales were up 33%.

Susan Chell is a real estate agent who knows the Kitchissippi area very well. A recent sale in Holland Station listed at $618,000 had 11 offers and went for $717,500 – that’s almost $100,000 over asking. That followed a recent record-breaking sale in Little Italy that went for $152,000 over asking.

“Ottawa never really saw $100,000 over listing [until now]. We’re seeing quite big numbers,” says Susan.

Most agree that LRT is driving a lot of attention and activity in Westboro, with many people wanting to be around that hub. However, investment activity is also on the rise, as can be seen through the number of infill applications and building permits being submitted.

In Ottawa, and in the west end in particular, much is coming down to supply. “The lack of inventory is driving the market. We have our regular buyers who are looking to buy up or get into the market and then we have our out-of-towners coming in and they have five days to buy a house and there is nothing for sale.”

In real estate though, things change day-to-day and week-to-week – and many homeowners often wait until the weather is better and flowers are in bloom.

It may be a sellers’ market, but that also means tactics are changing with “coming soon” notices and owners steeling for bidding wars.

Cleo Thompson saw the effects first hand, starting in May 2016. Cleo is an interior designer by trade and her husband Ryan purchased a home a number of years ago, fully renovated it and eventually deciding to list it.

A passion has turned into a full-time hobby and now a few years later, they are hoping that market and financing conditions will allow them to take on their fifth home.

“The house we sold two years ago, it was at the beginning of this trend. We listed at $899,000. It broke records for viewings. There were eight inspections and there were eight offers and it went for $152,000 over asking and no one could believe it. Everyone was scratching their heads,” says Cleo.

They then purchased another small house, eight doors down, and launched into a significant overhaul by adding a second storey and turning the home into a four-bedroom. Two weeks prior to their listing, a home a few streets over was in a three-way bidding war. But when they listed, at $1.25 million after fully renovating, they received only two offers and sold at $50,000 over list price. To many that’s a huge success, but to Cleo it could be a forecast of what is to come.

“Now, what we’re starting to see, is all the houses over that million mark are getting one or two offers – or they’re not getting offers at all,” offered Cleo, when asked her opinion. “So what seems to have happened in past five or six weeks is that the shift has now switched to everything that’s under a million. People are buying up all the houses that need work, whereas before everyone wanted the houses that were done.”

They used to buy homes in the $600,000 range with an investment of anywhere to $150-200,000, with a hopeful upside or profit margin of $200,000 or more. Now those starting prices in the ‘8s or 9s’ meaning it’s a very different financial formula to consider.

Stepping back though, the bidding wars and selling prices may make for great analysis – but the reality is that it’s a frustrating time for buyers in Kitchissippi and Ottawa in general. For a first-time buyer, it’s almost impossible to compete or even consider bidding on a million-dollar home.

When entering the market right now, strategy is everything. Susan’s advice is to make sure that buyers have their finances lined up ahead of time, know their threshold or limit, are prepared to navigate bids and know that they will need to complete home inspections.

The big question is whether Ottawa’s real estate situation is temporary. Susan doesn’t think so.

“I don’t think we’re in a bubble. I think Ottawa has been undervalued for years and we’ve been very affordable and we haven’t seen big appreciations like some of the other cities so I think we’re catching up a bit.”

As for Cleo, she hopes the market will still make it possible for her and her husband to keep doing what they love. “We’ve learned how to build so much that it’s become more than a hobby for us. We love it. I really hope that the market will allow us to continue fixing up these old homes. I like to take time to restore old homes and see them transform into something that fits the modern family.”